Dubai International Financial Centre (DIFC), the leading financial hub in the Middle East, Africa, and South Asia (MEASA) region, has recorded its highest-ever half-year results, significantly boosting its global standing and accelerating progress toward the goals of Dubai’s Economic Agenda D33.

In the first six months of 2025, DIFC welcomed a record number of new firms, bringing its total to 7,700 active registered companies—a 25% increase year-over-year. The number of newly registered firms surged by 32% compared to the same period in 2024, and workforce numbers rose to nearly 48,000, marking a 9% annual growth.

Sheikh Maktoum: Dubai is Stepping into the Top Global League

His Highness Sheikh Maktoum bin Mohammed Bin Rashid Al Maktoum, First Deputy Ruler of Dubai and Chair of DIFC, stated:

“The unprecedented results that the Dubai International Financial Centre continues to achieve, with outstanding and comprehensive performance across all fields, embody the vision of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, may God protect him, which aims to cement Dubai’s position at the forefront of the world’s most advanced financial centers. Dubai has entered a new phase of accelerated growth, and these results reflect its competitiveness, appeal, and the international confidence in its status. We believe the future holds even greater opportunities, and we will continue to enhance the capabilities of DIFC and its ecosystems that support innovation, resilience, and business growth.”

Climbing the Ranks in Global Finance

DIFC has firmly established itself as the only financial centre from the MEASA region ranked among the top global cities in the Global Financial Centres Index (GFCI). Dubai ranks:

-

5th in FinTech

-

6th in Professional Services

-

8th in Investment Management

-

9th in Infrastructure

-

10th in Business Environment

Currently, 980 firms operate under the supervision of the Dubai Financial Services Authority (DFSA), marking a 17% increase. Licenses issued for financial services rose by 28% compared to last year.

Wealth Management, Banking & Insurance on the Rise

Dubai continues to dominate regional capital markets. The number of banking and capital market firms in DIFC reached 289, up 17%. The wealth and asset management sector now includes 440 firms, a 19% jump, managing over 10,000 funds including 85 hedge funds.

Family businesses also grew significantly, with over 1,035 related entities now established—up 73%. The number of legal structures set up rose by 54% to 842 in H1 2025.

The insurance and reinsurance sector also expanded with 135 active companies—an 8% increase. Gross written premiums for 2024 reached $3.5 billion, a 35% rise from the previous year.

Attracting Global Financial Giants

DIFC added several global names to its ecosystem, including:

-

ABK Capital

-

Avaloq

-

PIMCO

-

Manulife

-

CICC

-

Bridge Investment Group

-

Cambridge Associates

-

NBK

-

Baron Capital

-

Silver Point Capital

Leadership in FinTech, AI & Innovation

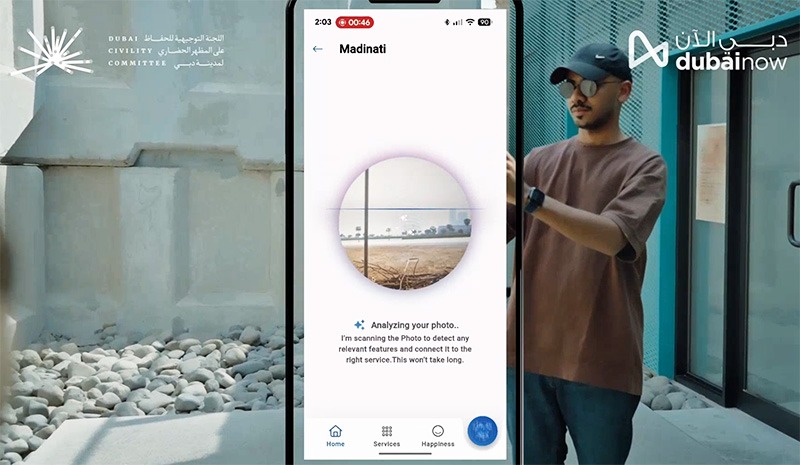

With 1,388 active FinTech and innovation companies—a 28% increase—DIFC has solidified its place among the world’s top five FinTech hubs. Non-financial firms within DIFC grew 28% to 6,335 entities.

Major events like the Dubai AI Festival and FinTech Summit drew over 20,000 participants from 120+ countries. During these, DIFC launched:

-

Dubai AI Academy

-

Dubai Future Finance Week (to debut in May 2026)

DIFC’s digital platform “Ignyte” has already delivered benefits worth AED 182 million to its users since its launch in late 2024.

An Educational Hub for Tomorrow’s Financial Talent

As part of Dubai’s Education Strategy 2033 and D33, DIFC Academy partners with top global universities such as Georgetown University, London Business School, and ESCP Business School, offering 12 master’s programs.

To date, over 46,000 learners have completed programs at DIFC Academy, including nearly 5,000 in H1 2025 alone—a record figure.

In a step toward long-term sustainability education, DIFC launched the “One Million Learners” initiative, aiming to train one million people in sustainable finance by 2030.

Pioneering Legal & Regulatory Framework

DIFC continues to update its legal infrastructure to stay aligned with global standards. Proposed updates include:

-

New regulations for Variable Capital Companies

-

Amendments to laws on security, insolvency, and employment

DIFC has also been selected to host the Global Privacy Assembly 2026, cementing its role in global data governance.

Thriving Real Estate and Urban Development

Real estate within DIFC is booming. The Heights Tower units sold out within three days of launch. Over 1.6 million sq. ft. of new commercial space is under development, to meet increasing demand.

DIFC has also launched a new real estate data platform for third-party access, supporting the objectives of Dubai’s Real Estate Strategy 2033.

With unmatched growth, regulatory leadership, global investor confidence, and forward-thinking innovation strategies, DIFC is not just shaping the future of finance in the region—it is actively defining the next chapter of global financial excellence.