The UAE’s insurance market has surged in recent years, driven by economic diversification and sweeping government mandates. In 2024 gross written premiums jumped about 21.4%, reaching AED 64.8 billion (USD 17.6 billion). This makes the UAE one of the fastest-growing insurance markets in the region. Abu Dhabi and Dubai dominate the industry, but rising coverage requirements have expanded demand nationwide. For example, the federal government has extended compulsory employer‑paid health coverage to domestic workers from January 2025. In Abu Dhabi, regulations in force since 2020 require property owners and tenants to insure their buildings. Meanwhile, all vehicles across the UAE must carry auto liability insurance. These policies are steadily broadening the insured population.

Key Insurance Segments

Most of the UAE market is in non-life insurance. Health and motor coverages are especially large, because employer-mandated health plans (already required in Abu Dhabi and Dubai) were extended nationwide for all private-sector workers from 2025. Auto insurance is compulsory for every driver and is strictly enforced. By contrast, life insurance remains a relatively small, voluntary market. Swiss Re notes that “non-life (including health) [is] more developed than life” in the UAE due to these mandatory programs, whereas life insurance lags because of lower public awareness and a transient expat population. Other growing segments include property and casualty insurance, boosted by real estate projects and new building codes (Abu Dhabi now forces all owners and tenants to insure against fire, floods, etc.), and Islamic (Takaful) insurance, which is gaining traction among Shariah‑oriented customers.

Key growth drivers include:

- Economic diversification. Major projects in real estate, energy and tourism create new risks, raising demand for property, construction and specialty insurance.

- Mandatory coverage. Expansion of required insurance (health for workers, motor for drivers, and property for buildings) directly adds millions of insured lives and assets.

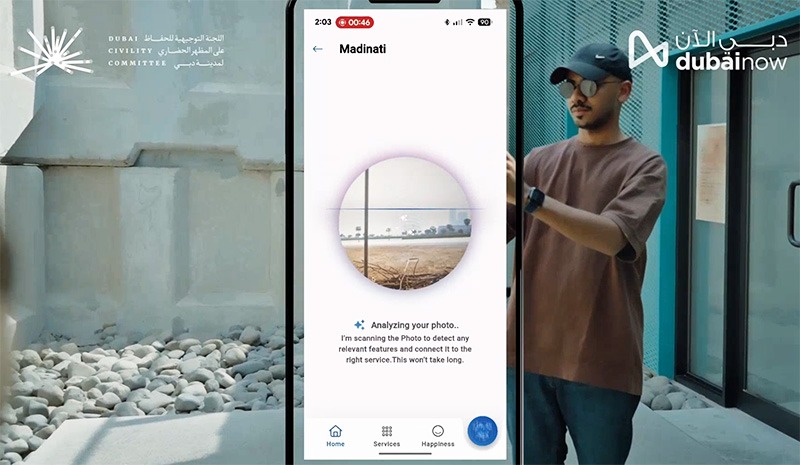

- Digital innovation. InsurTech platforms, mobile apps and AI are making it easier to buy and manage policies, attracting younger tech-savvy customers.

- Population growth and risk awareness. A rising, affluent expat population is increasingly aware of insurance benefits, further expanding the market.

Local Versus International Insurers

Domestic companies (like ADNIC, Oman Insurance/Sukoon, Orient, Alliance, etc.) currently write the lion’s share of UAE business. Latest Central Bank data show locally-licensed insurers accounted for about 73.3% of gross premiums in 2023 (up from 71.4% in 2022). International brands are also active: global names such as Bupa, Cigna and Aetna offer health plans, while Allianz (GIG), AXA, Zurich, Tokio Marine and others underwrite life and general insurance in the Emirates. Typically, foreign insurers operate through local branches or partners. In general, local firms have deep home-market expertise and customer networks, while international players bring extensive capital, global product lines and technology. The competition is intense; in some lines (especially motor) price wars have pressured profit margins even as premiums rise.

In 2025, non-life premiums growth in the UAE is expected to be around 10.8% supported by health, motor, and property lines.

The DIFC (Dubai International Financial Centre) recorded USD 3.5 billion in gross written premiums in 2024, but that was reported in a document published in 2025. However that number is from 2024, not 2025.

The UAE insurance industry reported 20% revenue growth in the first half of 2025, with total revenue reaching AED 20.42 billion during H1 2025.

Regulation and Oversight

Insurance in the UAE is regulated by federal authorities. Since 2020 the Central Bank of the UAE (CBUAE) has absorbed the former Insurance Authority, making the central bank the sole supervisor of insurers and brokers. A landmark 2023 insurance law (Federal Decree-Law No. 48/2023) further strengthened this framework, aligning regulations with global standards. Key provisions include strict capital and solvency requirements and a ban on so-called “non-admitted” insurance, meaning any policy covering UAE risks must be issued by a locally-licensed carrier. In practice, the CBUAE has signaled tougher enforcement: for example, in July 2025 it suspended a foreign insurer’s Dubai motor-coverage operation for failing to meet solvency rules. The regulator also helped introduce new mandates (such as the nationwide health-insurance scheme) and consumer protections. Moving forward, both homegrown and international insurers must meet higher regulatory standards or face penalties.

Industry analysts expect continued growth but note several challenges. Mandatory schemes and rising awareness should keep premiums climbing (Swiss Re forecasts 6% real growth in UAE non-life premiums for 2025), yet profitability remains under pressure. Severe weather events (recent floods) and high medical inflation drove claims sharply higher, Swiss Re reports a 52% jump in property and liability claims in 2024 (primarily fire, motor and engineering losses), which, along with a new corporate tax, have trimmed net margins. Competition and a crowded market (over 60 insurers) further squeeze earnings. As a result, experts predict gradual consolidation; smaller firms may merge or be acquired by larger players that can achieve scale and invest in technology. On the upside, innovation is booming: insurers are launching cyber policies, parametric (event-triggered) covers and other tailored products for UAE businesses.

For UAE consumers, the trend means more insurance options and (thanks to digital services) easier access to coverage. For the industry, success will hinge on balancing aggressive growth with strong underwriting discipline and regulatory compliance. In short, the Emirates’ insurers are enjoying a boom, but must navigate a tightened regulatory landscape and evolving risks to sustain that success