Dubai’s secondary property market—also known as the resale market—has shown remarkable resilience and activity in the first 10 months of 2025. Real estate experts confirm that the market recorded unprecedented levels of transactions, with resale deals growing by 20.85% year-on-year, reaching approximately AED 261.48 billion, compared to AED 216.36 billion during the same period last year.

Industry professionals attribute this strong performance to several factors: the eagerness of investors to seize opportunities in a diverse and dynamic market, wide-ranging price categories, banking facilities, and high rental and capital returns.

They noted that annual rental yields in the secondary market reach around 7% for residential apartments and 9% for commercial units or short-term rentals, while capital gains range between 10% and 20%, making the sector highly appealing for investors.

Banking Sector Supports Market Momentum

Experts also emphasized the key role played by the UAE’s banking sector in supporting the secondary market through innovative and accessible financing solutions. Initiatives such as reduced down payments for citizens and residents, first-time buyer incentives, and longer repayment plans—extending to 25 or 30 years—have revitalized demand, especially from new buyers.

Solid Demand Despite Supply Growth

Mohanad Alwadiya, CEO of Harbor Real Estate, stated that although the pipeline of new projects may appear large on paper, actual demand from both residents and international investors continues to grow. He clarified that this new supply is unlikely to create downward pressure on the secondary market, especially in well-established and high-demand communities with strong infrastructure.

Alwadiya added that many investors are showing preference for ready properties due to delays in some off-plan projects and rising financing costs. In his view, the current yields in the secondary market range between 5% and 7% net annually for residential units, and may exceed 8% to 9% for commercial or short-term rental units, particularly in tourist areas or locations close to metro stations.

He also pointed out that capital gains remain strong, with some mature communities witnessing price increases of up to 20% over the past 12 months.

Alwadiya noted that while rising interest rates in recent years have somewhat slowed down borrowing activity, overall demand remains solid, especially with increased cash purchases and a fresh wave of buyers entering the market as interest rates begin to drop locally and globally.

Expert Investment Advice

Alwadiya advised investors to adopt a smart strategy by focusing on off-plan properties in promising areas like Expo City Dubai, Dubai Creek Harbour, Jumeirah Garden City, and Dubai Islands—while also considering completed units in mature communities, where risk is lower and liquidity is higher.

He also stressed the importance of diversifying between long-term rental properties and furnished short-term rentals (holiday homes), as this can boost overall returns and reduce exposure to market fluctuations. Priority, he added, should be given to properties with true added value—such as spacious layouts, professional management, proximity to services, and well-developed infrastructure.

Resilience and Growth

Sharif Suleiman, Chief Revenue Officer at Property Finder, said Dubai’s secondary market has shown exceptional resilience in 2025, with transaction values growing by over 20.85%, and volumes increasing by 15.88% compared to the same period in 2024.

He emphasized that this performance reflects Dubai’s strong economic fundamentals, long-term residency policies, and the growing trend of property ownership among both citizens and expats.

Fast and Flexible Financing

Nader Talaat, CEO of Al Anqa Real Estate, highlighted Dubai’s rising status as a global hub for secondary real estate, supported by sustained economic growth and rising investment inflows. He stressed that the UAE banking sector has played a vital role, offering attractive financing packages—up to 75% of property value for first-time buyers, and 60% for ready property investors, at competitive rates.

Talaat explained that digital loan approvals—completed in less than 48 hours in most cases—now cover nearly 70% of applications, accelerating deal completion and increasing liquidity in the secondary market.

He added that local banks maintain high confidence in the market, thanks to strong regulation and a stable legal framework, which will continue to support long-term growth. Talaat anticipates the resale market to grow by 15–18% by year-end 2025, driven by strong rental demand and abundant banking liquidity.

He also noted the sector’s ongoing digital transformation, including blockchain use in mortgages and title transfers, which enhances transparency and reinforces Dubai’s position as one of the world’s most reliable and investment-friendly property markets.

A Key Driver of Liquidity

Mohamed Aboul Naga, CEO of Aboul Naga Real Estate Development, said the resale market is witnessing unprecedented demand from both investors and residents looking for ready-to-move-in properties or immediate returns.

He explained that rising capital values of new developments have prompted many buyers to shift toward competitive resale properties in strategic locations.

Aboul Naga added that rewarding rental yields, a stable regulatory environment, and long-term ownership incentives have boosted investor confidence—especially among foreigners.

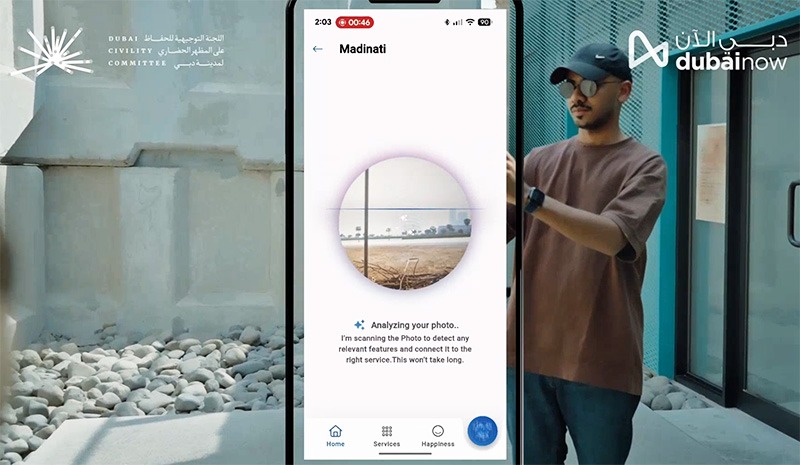

He stressed that Dubai’s real estate sector has developed a solid institutional framework, increasing market efficiency through enhanced transparency and digital platforms that simplify the buying process.

He also pointed out that the wide variety of residential areas and pricing options has broadened the buyer base in the resale market, making it not just an alternative to the primary market, but a complementary driver of liquidity in Dubai’s property sector.

By the Numbers

-

AED 261.48 billion: Value of resale transactions from Jan–Oct 2025

-

+20.85%: Year-on-year increase in resale value

-

73,579 transactions: Completed resale deals in 10 months

-

+15.88%: Growth in number of transactions compared to 2024

-

98.8%: Portion of 2025 value compared to all of 2024

-

94.5%: Share of 2025 resale deals vs. total 2024 deals

Dubai’s secondary real estate market continues to demonstrate exceptional strength and profitability in 2025, driven by strong investor interest, flexible financing, and a maturing institutional framework. As it evolves alongside the city’s broader economic growth, the resale market is well-positioned to remain a key engine of investment and long-term returns